Overview

Global buyers increasingly demand certified products that comply with regional regulations. From CE marking for Europe, ASTM standards for the US, to BIS certification in India, compliance testing is often the key factor determining market entry.

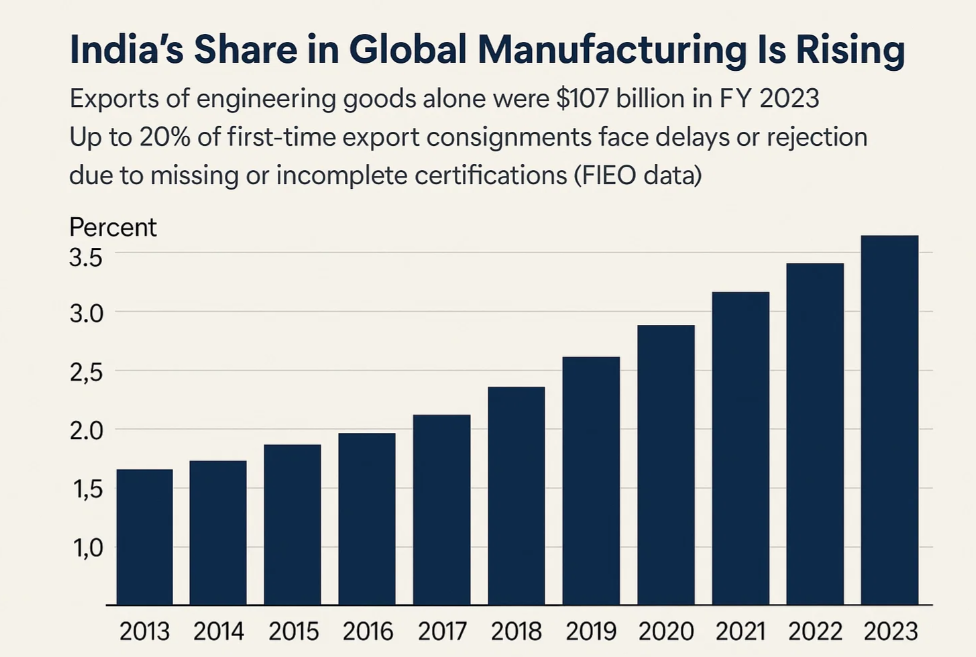

India’s Context

India’s share in global manufacturing is rising—exports of engineering goods alone were $107 billion in FY 2023—but up to 20% of first-time export consignments face delays or rejection due to missing or incomplete certifications (FIEO data).

Our Role

- End-to-End Coordination: Liaison between Indian manufacturers and accredited testing labs (both NABL-accredited in India and global labs like SGS, TUV, Intertek).

- Regulatory Guidance: Map certification requirements for the target market.

- Sample Management: Pick-up, sealing, and dispatch to labs under chain-of-custody protocols.

- Expedited Testing: Negotiate priority slots for urgent shipments.

- Certification Support: Assistance in applying and filing paperwork for BIS, ISI, CE, RoHS, REACH, ASTM, and others.

Key Product Categories & Standards

- Textiles: AZO-free, REACH compliance.

- Toys & Children’s Products: EN71, ASTM F963.

- Electronics: CE, RoHS, BIS CRS Scheme.

- Food Contact Items: FDA, LFGB, IS standards.

- Building Materials: ASTM, IS, ISO.

Data-Driven Impact

An International Trade Centre study indicates that faster compliance clearance can cut time-to-market by 25–40 days, improving buyer satisfaction and reducing penalty costs. If Indian exporters halve their certification delays, they could gain $2–3 billion in extra orders annually, particularly in sectors where speed to market is critical.