Why it matters: Quotes don’t live in a vacuum. IndiaUnbox breaks every quote into a should-cost model and compares it with live market benchmarks so you never overpay.

What we analyze (and benchmark against)

- Raw materials: We map quoted material costs to publicly available indices and circulars.

Examples:

– Polymers: Indian Oil’s August 1, 2025 revision cut PP by ₹1,500/MT (≈ ₹1.5/kg) — a saving many quotes fail to pass through.

– Textiles: The global Cotlook A Index was 78.20 on Aug 12, 2025, useful for cross-checking cotton-linked asks.

– Metals: India’s wholesale prices show manufactured product inflation dynamics suppliers often cite; manufactured products rose ~2.05% YoY in July 2025 even as headline WPI fell. - Energy & fuel: We validate power and fuel assumptions.

– Diesel (Delhi RSP): ₹87.67/litre on Aug 14, 2025 — vital for road-freight line items.

– Industrial power: We reference CEA’s consolidated tariff books to sanity-check kWh rates used in conversion costs. - Freight & logistics: We align quotes with container and dwell-time realities.

– Ocean freight: Drewry’s World Container Index stood at $2,424 per 40ft on Aug 7, 2025 (weekly).

– Port dwell: JNPA’s June 2025 overall export dwell time ~75 hours affects storage/detention risk baked into quotes. - FX exposure: We normalize USD and EUR-denominated inputs to RBI/FBIL reference rates so suppliers don’t “pad” currency moves (e.g., USD/INR 87.5776–87.6956, Aug 8–13, 2025).

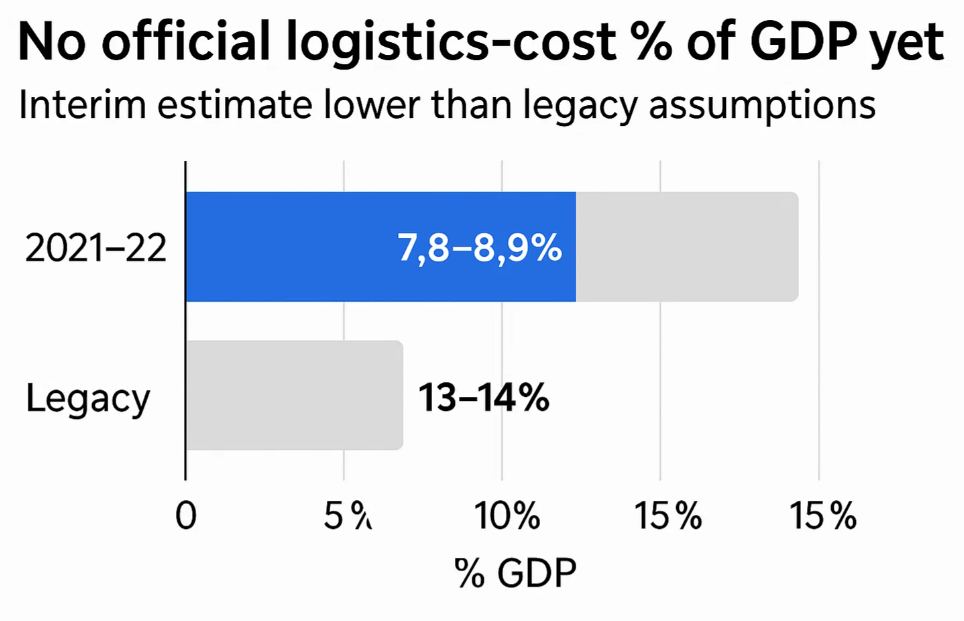

- Structural logistics cost context: We factor the evolving India logistics landscape when validating systemic add-ons in quotes.

– Parliament recently noted no official logistics-cost % of GDP yet (study underway with NCAER), while an interim DPIIT/NCAER assessment estimates 7.8–8.9% of GDP (2021–22) — lower than legacy 13–14% assumptions that some suppliers still use to justify surcharges.

How IndiaUnbox builds your “should-cost”

- Decompose the quote: BOM → conversion (labour, power, fuel) → factory overheads → packaging → inland freight → ocean/air → duties/levies → risk/finance margin.

- Pin each component to a benchmark: WPI series, commodity circulars, official fuel/power rates, FX references, container indices, and live dwell-time data.

- Quantify gaps: We flag where the supplier is above, in-line, or below market and translate that into negotiation levers (e.g., “pass through PP ↓₹1.5/kg”, “use current WCI spot”, “revise diesel escalator”).

- Scenario & sensitivity: We show how ±5% FX or ±$200/FEU freight swings change the fair price so you can lock terms confidently.

A quick, numbers-first example

- Material pass-through: PP cut of ₹1,500/MT ⇒ ₹1.5/kg. If your part uses 0.8 kg PP, fair material should drop ₹1.20 per unit. On 10,000 units, that’s ₹12,000 direct saving to claim.

- Freight sanity-check: With WCI at $2,424/FEU, a quoted $3,100/FEU on a mainline should trigger justification or renegotiation to index-link.

- Fuel logic: If a supplier’s road-freight surcharge assumes diesel at ₹95–100/litre, we reset to ₹87.67/litre (Delhi) unless corridor-specific evidence says otherwise.

- Port time risk: Where quotes load detention buffers assuming ~4+ days at port, we challenge using ~75 hours recent export dwell at JNPA, adjusting the buffer to reality.

What you get

- Benchmark Sheet (1–2 pages): Quote vs. market for each cost line, with source-linked footnotes.

- Should-Cost & Savings Map: Clear target price, itemized deltas, and the asks we’ll take into negotiation.

- Supplier-ready Rationale Pack: Crisp, source-backed points that make concessions hard to refuse.

Typical sources we use (examples)

- WPI & manufacturing trends: Office of Economic Adviser; July 2025 WPI release & coverage.

- Fuel & crude: PPAC (official petrol/diesel RSP; Indian basket crude).

- Ocean freight: Drewry World Container Index (weekly).

- Port performance: NICDC LDB analytics (dwell times by port/terminal).

- Polymers: IOCL/market circulars consolidated by Plastemart (monthly/adhoc revisions).

- FX: RBI/FBIL reference rates via NSE India.

- Cotton: Cotlook A Index.

- Steel market context: JPC (Ministry of Steel) trend reports.

Why this helps you win negotiations

Suppliers expect pushback; they rarely expect sourced evidence tied to every rupee and dollar in their quote. Our benchmarked should-cost makes your position objective, current, and defensible—turning “please reduce” into “here’s exactly where and why to reduce.”