Our promise: Lower total landed cost, same or better quality. IndiaUnbox comes to the table with verifiable benchmarks, manufacturing know-how, and enforceable quality safeguards—so price reductions never translate into hidden defects or delays.

What we negotiate (beyond unit price)

- Index-linked pricing: Tie resin, steel, and paper components to public indices; ocean legs to an independent freight index; diesel surcharges to the official RSP. This removes “padding” and keeps prices fair through the contract life.

- Terms & cash flow: Use India’s MSME 45-day payment framework to trade faster, compliant payments for better rates—structuring win-wins without starving supplier liquidity.

- MOQs, tooling & packaging: Rightsize order minimums, amortize tooling transparently, and optimize packaging to cut freight and damage costs—without touching spec.

How we make sure quality never slips

- Specs locked + sampling by standards: We fix drawings/specs and police incoming lots with AQL sampling per ISO 2859-1 (critical = 0, major/minor by agreement).

- QMS evidence, not promises: Vendors must meet relevant QMS norms (e.g., ISO 9001; IATF 16949 for auto supply chains where applicable).

- Compliance first: Where Indian BIS Quality Control Orders (QCOs) apply, we verify license status and include it as a non-negotiable clause.

- First-article/PPAP when needed: For engineered parts, we mandate first-article/production approval before mass runs, so cost-downs don’t create rework later.

The data we bring to every negotiation

- Ocean freight reality check: Drewry’s World Container Index was $2,424 per 40ft (week of 7 Aug 2025). If quotes assume higher spot, we index-link or reset to market.

- Fuel surcharges grounded in facts: Delhi diesel RSP was ₹87.67/litre (12 Aug 2025)—we calibrate overland freight add-ons to current official levels.

- FX transparency: Contracts reference FBIL/RBI rates (e.g., USD/INR reference series published via NSE), removing “buffered” exchange assumptions.

- Port performance & buffers: With PAN-India export dwell ~88.5 hours (May 2025), we challenge excessive detention/storage cushions.

- Payment-terms leverage: Under the MSME regime, buyers delaying beyond 45 days lose tax deductibility until payment—an objective lever to justify early-payment discounts in exchange for lower unit prices.

A typical playbook (condensed)

- Normalize the quote to current benchmarks: freight → WCI, fuel → PPAC RSP, FX → FBIL, compliance → BIS/QCOs.

- Protect the spec: lock drawings and AQL plan (e.g., critical 0; major/minor as agreed) so cost gives never touch performance or safety.

- Trade smart, not hard: offer faster, MSME-compliant payments for a structured price step-down; reduce MOQs with line-rate adjustments rather than hidden margin grabs.

- Bake it into the contract: add indexation clauses, quality KPIs (AQL/PPM, OTIF), corrective-action SLAs, and reopeners if indices move beyond agreed bands.

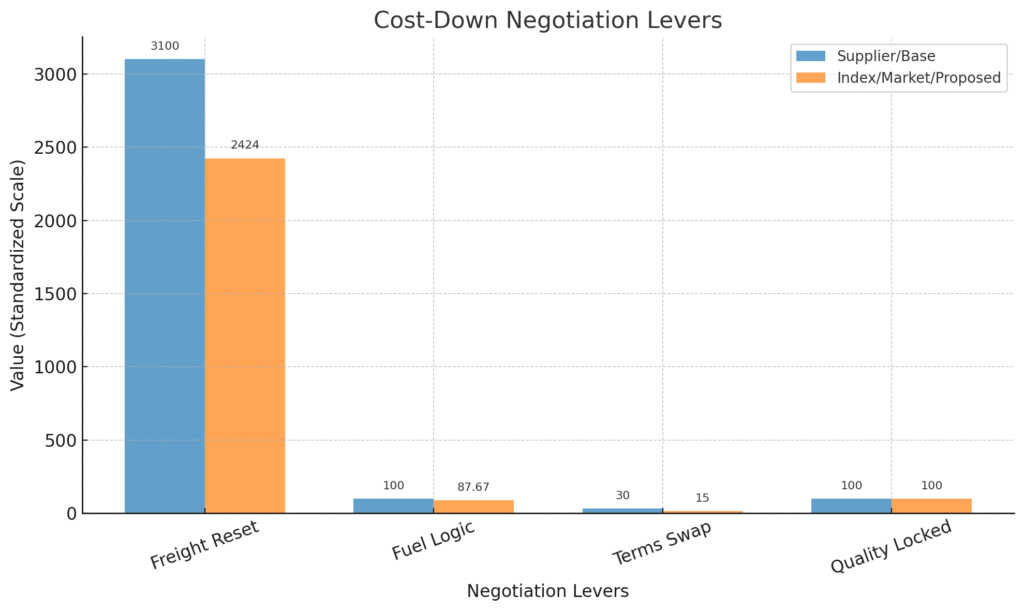

Example—turning data into savings (without quality risk)

- Freight reset: Supplier bases price on $3,100/FEU; WCI shows $2,424/FEU. We push an index-link or a reset to the weekly print—clean, defensible cost-down.

- Fuel logic: Quote assumes ₹95–100/litre diesel; PPAC shows ₹87.67. We adjust inland freight and remove outdated escalators.

- Terms swap: We propose 15–30-day payment against MSME rules to unlock an early-payment discount, documented as a price term—not as an untracked credit note.

- Quality locked: AQL per ISO 2859-1 and ISO 9001/IATF conformance are written into the PO with rejection/containment rights, so cost-downs don’t degrade incoming quality.

Your deliverables

- Negotiation Dossier: Supplier quote vs. benchmarks, variance map, and scripted asks—each point footnoted to a public source.

- Quality Guardrails Pack: AQL plan, first-article/PPAP checklist (as applicable), BIS/QCO verification sheet, and non-conformance remedies.

- Signed Terms Addendum: Index-linked pricing, service levels (OTIF, PPM), corrective-action timelines, and review cadence anchored to the same benchmarks used to win the reduction.

Bottom line: We don’t haggle—we evidence. By coupling price asks with hard benchmarks and contractual quality controls, IndiaUnbox drives sustainable cost-downs that survive audits and keep your customers happy.