Outcome we drive: the right space, in the right city, on the right terms—so inventory turns faster and costs stay predictable.

Where we place your stock (backed by market data)

- Tier-1 hubs covered: Mumbai (Bhiwandi), Delhi-NCR (KMP/NH-48), Bengaluru (Attibele–Bommasandra), Chennai (Sriperumbudur–Oragadam), Ahmedabad (Changodar–Sanand), Pune (Chakan–Talegaon), Kolkata (Dankuni), Hyderabad (Medchal). Together, India’s top eight markets host ~45.1 mn sq m (≈486 mn sq ft) of warehousing stock with ~11.5% vacancy (2024)—ample choice without sacrificing service.

- Grade-A availability: About 41% of stock in primary markets is modern Grade-A—ideal for automation, higher racking, and strict QA workflows.

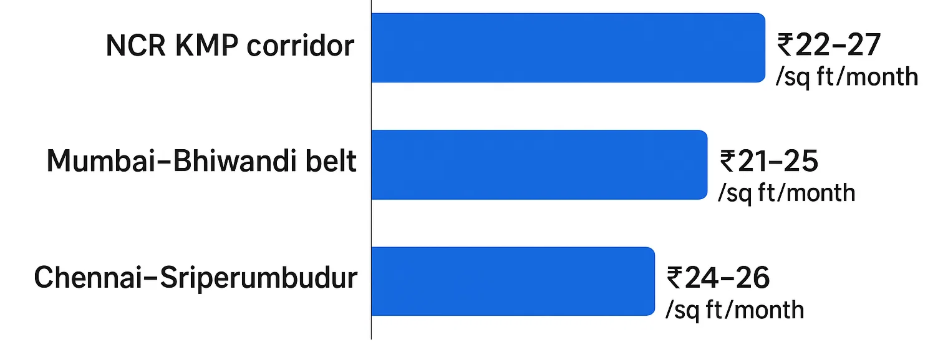

- Fact-checked rent bands (illustrative):

– NCR KMP corridor: Grade-A ₹22–27/sq ft/month.

– Mumbai–Bhiwandi belt: Grade-A ₹21–25/sq ft/month.

– Chennai–Sriperumbudur: Grade-A ₹24–26/sq ft/month.

What we offer (short-term to long-term)

- Short-term (overflow, cross-dock, project peaks): Rapid intake, palletization, scan-in/scan-out, quality holds per your AQL, and carrier turn-times aligned to port/airport cut-offs.

- Long-term (contract warehousing): Dedicated zones, SOPs, cycle counting, ASN/EDI, KPI dashboards (OTIF, PPM, pick accuracy), and cost-down through slotting & layout optimization.

- Bonded & duty-deferred options: For import-heavy flows, we set up customs-bonded (MOOWR/Section 65) operations so basic customs duty is deferred until home-clearance; duty is remitted on exports. Recent CBIC guidance clarifies inter-unit transfers between Section-65 warehouses, keeping intra-India flows clean.

- Temperature-controlled: Chilled/frozen chambers, GDP/GWP-ready handling, and FSSAI-compliant storage practices where food products are involved. (FSSAI rules require storage at prescribed temperatures—even pre-clearance in customs warehouses.)

- Hazardous & regulated goods: Where needed, we align storage licensing to PESO Petroleum Rules thresholds and local fire/EHS norms.

Why our hubs move faster (and cost less)

- Rail + road leverage: We preferentially locate near the Dedicated Freight Corridors (EDFC fully commissioned; WDFC ~93% complete; overall ~96.4% project progress) to lift reliability and cut line-haul times.

- Next-gen logistics parks: We tap the government program of 35 approved Multi-Modal Logistics Parks (MMLPs) to combine storage with rail/road connectivity and value-added services.

- Digital visibility: Our facilities and transport partners interface with ULIP—the national data spine that crossed 100 crore (1 billion) API transactions—to improve milestone tracking and reduce manual follow-ups.

How we right-size your footprint

- City shortlist with numbers: Stock/vacancy, Grade-A share, typical rent bands, and access to ports/airports/DFCs—so location choice is objective, not anecdotal.

- Layout & racking plan: Clear height, floor load, dock count, MHE paths, and WMS integration mapped to your SKU profile (fast/slow movers, temperature needs).

- Compliance pack: Warehouse licenses & SOPs (FSSAI where applicable, PESO for flammables, bonded/MOOWR where chosen), plus audit templates and safety drills.

- Commercials & SLAs: Transparent cost sheet (rent, CAM, utilities, manpower), KPI targets (dock-to-stock, pick accuracy, inventory accuracy), and quarterly review cadence.

Your deliverables

- Warehousing Location Dossier: 2–3 city options with cost, service, and risk trade-offs (rent, free-time, connectivity, regulatory posture).

- Operating Blueprint: SOPs, WMS data model, slotting, audit checklists, and escalation paths.

- Bonded/Compliance File (if opted): MOOWR documentation map, duty-flow examples, and license/register templates.

Bottom line: IndiaUnbox blends hard market data with on-ground execution—so whether you need a two-week buffer or a multi-year campus, your warehouse is placed where it performs, priced where it should be, and compliant from day one.